Traveling with Reward Points & Reward Credit Cards

Those that know me know that I’m the queen of maximizing Reward Points & Reward Credit Cards. I’ve been told numerous times to write about all the point programs I take advantage of and how I travel for free (or on points). So, here you’ll find a recap of my favorite Reward Credit Card Programs as well as some great Reward Shopping programs I take advantage of to earn points to use for my travel.

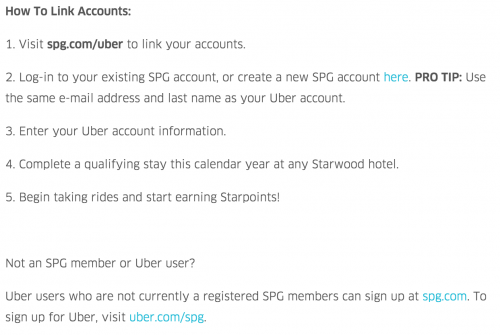

Travelling via Uber and earning Starwood American Express Points – This is the latest collaboration from my favorite Starwood American Express. It’s super easy, just log into your Starwood account and link it to your uber account (with your uber log in and password. Note, in order to qualify you must “complete one qualifying SPG® stay this calendar year. Once you have completed a qualifying SPG stay this calendar year, you’ll be all set to start earning Starpoints® with Uber”. Just another easy way to earn points with spending you’re already doing!

Starwood American Express – I have been using the Starwood Amex card for over 12 years and I’m still obsessed with it. Years ago, Katherine, J.S.F. Board of Advisors Member was working at American Express and the word in the office was that this was the best card within American Express. After planning a vacation with a boyfriend who at the time had the platinum American Express card, I learned that my points went twice as far as his American Express Platinum Points. The funny part is that card has an annual membership of $450 and the Starwood American Express is $95. However, that card does get you access into over 60 airport lounges which the Starwood card doesn’t but I’ll take points going twice as far for travel vs. airport loungers. Depends on what you look for when you travel. A few reasons why the Starwood American Express card is amazing:

Earn 10,000 Starpoints after your first purchase on the Card and an additional 15,000 Starpoints after you use your new Card to make $5,000 in purchases within the first 6 months for a total of 25,000 bonus Starpoints

Redeem Starpoints for free nights at over 1,100 hotels & resorts in nearly 100 countries and for free flights on over 150 airlines with SPG Flights – all with no blackout dates.

Starpoints stay active as long as you continue to spend on your Card.

Some hotels may have mandatory service and resort charges.

$0 introductory annual fee for the first year, then $65.

Citi Advantage Platinum Select Mastercard – I discovered this card recently as I was looking for a new credit card for my business expenses. I quickly realized this was a great card for my travel and spending needs. A few things I like about this include: First, the 50K bonus miles and 2 Admiral Club passes earned after spending $3K in first 3 month (that’s easy to do!). Second, one free checked bag. Third, group one boarding. It sounds silly but I hate when I’m group 3 or 4 and told I need to check my bag. Lastly, I like that I can earn 10% of my mileage back. Just a fun additional perk I’ve never seen with any other cards on top of the other things that work for my travel needs.

Earn 50,000 American Airlines AAdvantage® bonus miles and 2 Admirals Club® Passes after making $3,000 in purchases within the first 3 months of account opening*

Your first eligible checked bag is free*

Group 1 boarding and 25% savings on eligible in-flight purchases*

Earn a $100 American Airlines Flight Discount every cardmembership year with qualifying purchases and cardmembership renewal*

Double AAdvantage® miles on eligible American Airlines purchases*

Earn 10% of your redeemed AAdvantage® miles back – up to 10,000 AAdvantage® miles each calendar year*

Annual fee of $95 waived the first 12 months

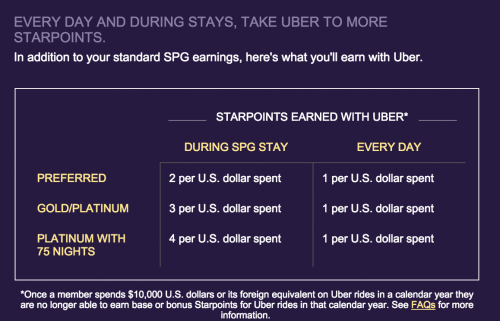

American Express Business Platinum Card – Although I do not personally use this card (due to the high $450 annual fee) for those that travel a lot or want the perks it offers I think it’s a great card, especially, if it’s a business card and the company will pay the annual fee. There are a few things that I find appealing about this card. First, the 40K membership reward earned after spending $5K during the first 3 months. Second, access to 600 airport lounges. Let’s be honest hanging in a lounge is way nicer than sitting at a gate. You get to enjoy showers (in some), free food, drinks, wifi and other perks depending on the lounge. Fabulous I know! Third, the free boingo hotspot access which can save you a lot of money since you typically you pay $10-$24.99 for boingo fees (based on the hours you buy…). So if you travel 10-20 trips a year that’s already $100-$499 savings). Lastly, their Business Platinum Concierge service. For someone who wants to just call an expert to book travel, hotels, restaurants this will offer you that luxury.

American Express Business Platinum Card – Although I do not personally use this card (due to the high $450 annual fee) for those that travel a lot or want the perks it offers I think it’s a great card, especially, if it’s a business card and the company will pay the annual fee. There are a few things that I find appealing about this card. First, the 40K membership reward earned after spending $5K during the first 3 months. Second, access to 600 airport lounges. Let’s be honest hanging in a lounge is way nicer than sitting at a gate. You get to enjoy showers (in some), free food, drinks, wifi and other perks depending on the lounge. Fabulous I know! Third, the free boingo hotspot access which can save you a lot of money since you typically you pay $10-$24.99 for boingo fees (based on the hours you buy…). So if you travel 10-20 trips a year that’s already $100-$499 savings). Lastly, their Business Platinum Concierge service. For someone who wants to just call an expert to book travel, hotels, restaurants this will offer you that luxury.

Earn 40,000 Membership Rewards® points after you spend $5,000 in purchases on the Card within your first 3 months of Card Membership

20% Travel Bonus when using Membership Rewards® Pay with Point

Complimentary access to over 600 airport lounges worldwide

Enjoy complimentary, unlimited Boingo Wi-Fi at more than 1,000,000 Boingo hotspots worldwide

Business Platinum Concierge is like your own assistant, ready to help you with just about anything personal or professional, 24 hours a day

$450 Annual Fee

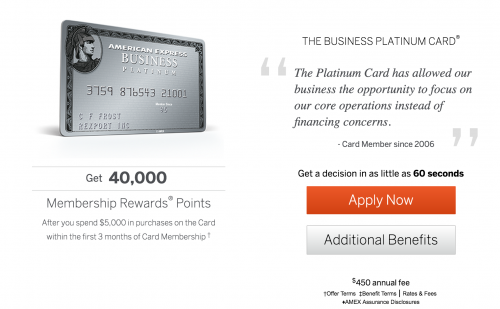

Chase Sapphire Preferred – This is a card I personally use for 4 reasons: First, I get double points on Food & Travel (which is about 85% of my spending). Second, there are no international fees. Another important perk for all the travel I do. Third, it’s very flexible in terms of using the points. You can book travel with chase.com on various airlines and hotel chains so you’re not limited to one airline or one hotel brand or you can transfer the points to 11 transfer partners. Lastly, the 40K points you can earn by spending $4000 in the first 3 months earns you a free ticket. It’s quite a card and only $95 per year (waived the first year).

Earn 40,000 points when you spend $4,000 on purchases in the first 3 months.

2x points on travel and dining

NO foreign transaction fees, primary auto rental insurance and

The ability to transfer points to 11 transfer partners

$95 annual fee that is waived the first year.

What do you think?